Global Payout

Transform your crypto-to-fiat distribution with Noah's Global Payout solution. Convert cryptocurrency to over 120 fiat currencies and deliver payments through local methods worldwide—from bank transfers to mobile money—eliminating complex international banking relationships while reducing settlement times from days to minutes.

Convert crypto and stablecoins to fiat, and payout through local payment methods.

The Business Challenge

Global crypto-to-fiat distribution is limiting your reach:

- Complex international banking relationships restrict market expansion

- Multiple payment provider integrations create operational overhead

- Manual currency conversion processes delay settlements and increase costs

- Limited local payment options exclude large customer segments

- Compliance complexity across jurisdictions creates legal risks

- High cross-border transfer fees eat into profit margins

- Inconsistent settlement times frustrate customers and partners

Our Solution

Payouts API can facilitate first or third party transactions to businesses and customers, supporting a range of usecases such as offramping, remittance and B2B settlements. The Reliance Model allows your business to share KYC and KYB data with Noah to remove the need for redundant resubmission of information. As an alternative to the Reliance Model, use the Standard Model, in support of which a Hosted Onboarding journey is provided.

Noah's Global Payout solution provides instant crypto-to-fiat conversion with delivery through local payment methods across 60+ countries. Convert your cryptocurrency holdings to local currencies and distribute payments via the most appropriate channels for each region—bank transfers, mobile money, digital wallets, or cash pickup—all through a single integration.

How It Works (Business View):

- Add recipients with simplified identity or business details

- Select destination country and currency to see available payment channels

- Choose optimal method based on lowest fees, fastest settlement, or balanced options

- Get real-time pricing with transparent exchange rates and fee breakdowns

- Submit payout request with instant settlement and automated processing

- Track completion through notifications and comprehensive dashboard reconciliation

Our solution supports both first-party and third-party transactions for offramping, remittances, and B2B settlements, with flexible funding from your crypto accounts or triggered automatically by customer deposits.

Key Business Benefits

Global Market Access

- Universal reach: Serve customers across 60+ countries with local payment preferences

- Local expertise: Native payment methods for each region increase acceptance rates

- Single integration: One system replaces multiple regional payment providers

- Market expansion: Enter new territories without establishing local banking relationships

- Competitive positioning: Offer superior payment options vs. competitors limited to traditional methods

Operational Efficiency

- Automated processing: End-to-end conversion and distribution without manual intervention

- Instant settlements: Funds delivered through local systems rather than slow international transfers

- Dynamic forms: Automated field management across hundreds of payment method requirements

- Simplified reconciliation: Complete transaction tracking through unified dashboard

- Flexible funding: Choose direct crypto settlement or customer-triggered transactions

Cost Optimization

- Transparent pricing: Real-time exchange rates aligned with mid-market rates

- Fee flexibility: Absorb costs or pass fees to customers based on your business model

- Reduced overhead: Eliminate multiple payment provider relationships and associated costs

- Lower settlement costs: Local payment networks reduce traditional correspondent banking fees

- Optimized routing: System recommends lowest-cost channels for each transaction

Customer Experience

- Familiar payment methods: Local options customers trust and understand

- Faster delivery: Regional payment systems offer same-day or instant settlement

- Global consistency: Unified experience regardless of recipient location

- Multiple options: Bank transfers, mobile money, digital wallets, cash pickup

- Real-time transparency: Customers see exact costs and delivery timeframes upfront

Use Cases by Industry

Cryptocurrency Exchanges

Challenge: Customers need fast, reliable fiat withdrawals to local payment methods globally Solution: Instant crypto conversion with delivery through preferred local channels Benefit: Expand customer base globally while reducing withdrawal processing complexity

Remittance Services

Challenge: High costs and slow settlement times for cross-border money transfers Solution: Crypto-enabled transfers with local currency delivery via mobile money and bank transfers Benefit: Compete with traditional remittance providers while offering superior speed and cost

Gig Economy Platforms

Challenge: Paying freelancers and contractors worldwide through diverse payment preferences Solution: Automated crypto-to-fiat conversion with local delivery methods for each region Benefit: Attract global talent by offering payment methods that work in their local markets

E-commerce Marketplaces

Challenge: Settling with sellers across multiple countries using different payment systems Solution: Convert marketplace crypto revenues to local currencies via appropriate regional methods Benefit: Enable truly global marketplace operations without complex multi-currency banking

Gaming & Entertainment

Challenge: Distributing winnings and payments to global user base efficiently Solution: Automated payouts to winners in their preferred local currency and payment method Benefit: Enhance user experience while simplifying international payment operations

Global Payout Workflow System

Our comprehensive payout system provides intelligent routing and optimization capabilities:

Recipient Management: Add recipients using simplified identity verification, with support for both individual consumers and business entities through our Reliance Model for KYC data sharing.

Channel Optimization: Select optimal payment channels based on your priorities—lowest settlement time, lowest fees, or balanced options—with real-time comparison data.

Dynamic Forms: Automatically render appropriate payment forms for each method, eliminating the complexity of managing hundreds of form fields across different payment systems.

Real-Time Pricing: Receive instant currency exchange estimates that can be presented to customers with or without fees, depending on your business model.

Flexible Settlement: Fund payouts through instant settlements from your crypto reserves or enable customer-triggered transactions from designated blockchain addresses.

Complete Reconciliation: Track and manage all transactions through comprehensive business dashboard with detailed reporting capabilities.

Implementation Overview

Business Requirements

- Timeline: 2-3 weeks from contract to go-live for white-label integration

- Resources: Single API integration replaces multiple payment provider relationships

- Compliance: Noah handles regulatory requirements across all supported jurisdictions

- Training: Comprehensive onboarding for your operations and finance teams

Integration Options

White-Label Integration

- Complete control: Full control over user flows and branding within your application

- Direct backend integration: Single API endpoint handles global payout capabilities

- Custom experience: Seamlessly integrate fiat payout capabilities into existing platform

- Brand consistency: Maintain customer relationships throughout the entire process

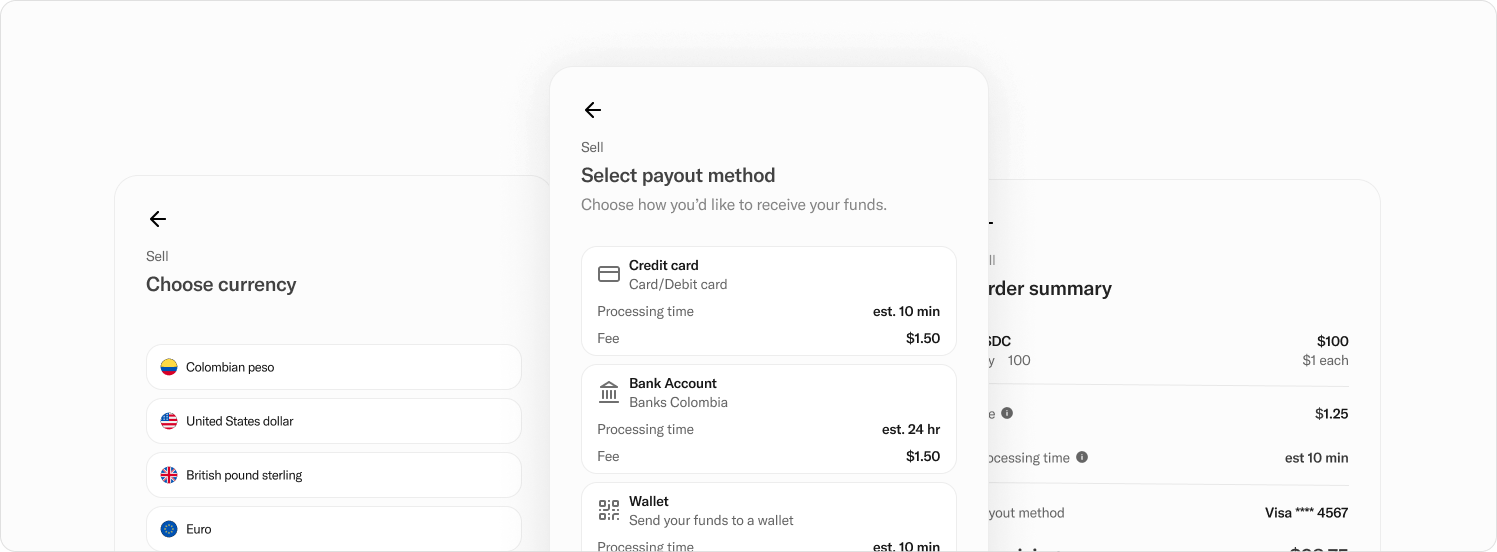

Hosted Offramp Interface

- Streamlined setup: Consumer-friendly interface guides users through payout process

- Minimized drop-off: Optimized user experience reduces abandonment rates

- Multiple payment methods: Access to comprehensive range of regional payment options

- Reduced development: Minimal integration effort for immediate global market access

Dashboard Payouts

- Direct processing: Execute payouts directly through business dashboard

- Manual control: Perfect for B2B settlements and ad-hoc payments

- Batch processing: Handle multiple payouts efficiently through unified interface

What We Handle

- Global compliance: Regulatory adherence across all supported jurisdictions

- Payment relationships: Established connections with local payment providers worldwide

- Currency exchange: Real-time conversion at competitive rates from top exchanges

- KYC processing: Comprehensive identity verification or data sharing through Reliance Model

- Risk monitoring: Automated fraud detection and transaction monitoring

- Settlement processing: Instant crypto conversion and local currency delivery

What You Control

- Fee structure: Choose to absorb costs or pass fees to customers

- Payment routing: Select optimal channels based on your business priorities

- Customer experience: Design user flows that match your brand requirements

- Funding preferences: Direct crypto settlement or customer-triggered transactions

- Reconciliation approach: Access detailed transaction data for accounting and reporting

Supported Payment Methods & Coverage

Local Payment Methods

- Bank Transfer: Direct deposits to local bank accounts

- Real-Time Payment Systems: Instant transfers (PIX, UPI, FasPayments, etc.)

- Mobile Money: Popular across African and Asian markets

- Digital Wallets: PayPal, regional wallet providers, and local solutions

- Cash Pick-Up: Physical locations for unbanked populations

- Card Payouts: Direct to debit/credit cards (available via Hosted Offramp)

- ACH, Wire, RTP & FedNow: Popular across US markets

Supported Cryptocurrencies & Networks

| Digital Currencies | Base | Bitcoin | Celo | Ethereum | FlowEvm | Gnosis | Lightning | OffNetwork | Polygon PoS | Solana | Tron |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | ✓ | ||||||||||

| CELO | ✓ | ||||||||||

| ETH | ✓ | ||||||||||

| EURC | ✓ | ||||||||||

| FLOW | ✓ | ||||||||||

| MATIC | ✓ | ||||||||||

| PYUSD | ✓ | ✓ | |||||||||

| SOL | ✓ | ||||||||||

| TRX | ✓ | ||||||||||

| USDC | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| USDT | ✓ | ✓ | ✓ | ✓ | |||||||

| XDAI | ✓ |

Sandbox Cryptocurrency Naming Convention

Be aware that CryptoCurrencies used in the Sandbox always have a _TEST suffix, such as BTC_TEST and USDC_TEST.

Global Market Coverage

Currently supporting over 120 fiat currencies across 60+ countries in four major regions. Additional countries and currencies available for card payouts via Hosted Offramp.

Asia-Pacific (APAC)

| Currency | Country |

|---|---|

| AUD | Australia |

| NZD | Cook Islands |

| FJD | Fiji |

| HKD | Hong Kong |

| INR | India |

| IDR | Indonesia |

| MYR | Malaysia |

| NZD | New Zealand |

| PHP | Philippines |

| WSM | Samoa |

| SGD | Singapore |

| KOR | South Korea |

| THB | Thailand |

| TOP | Tonga |

| AED | UAE |

| VUV | Vanuatu |

Africa

| Currency | Country |

|---|---|

| XOF | Benin |

| XAF | Chad |

| XOF | Cote D'Ivoire |

| ETB | Ethiopia |

| XAF | Gabon |

| GHS | Ghana |

| MWK | Malawi |

| NGN, USD | Nigeria |

| RWF | Rwanda |

| SLL | Sierra Leone |

| ZAR | South Africa |

| XAF | The Republic of Congo |

| UGX | Uganda |

Europe

| Currency | Country |

|---|---|

| EUR | Austria |

| EUR | Belgium |

| EUR | Croatia |

| CZK | Czech Republic |

| DKK | Denmark |

| EUR | Estonia |

| EUR | Finland |

| EUR | France |

| EUR | Germany |

| EUR | Greece |

| EUR | Ireland |

| EUR | Italy |

| EUR | Latvia |

| EUR | Lithuania |

| EUR | Luxembourg |

| EUR | Netherlands |

| NOK | Poland |

| EUR | Portugal |

| RON | Romania |

| EUR | Slovakia |

| EUR | Slovenia |

| EUR | Spain |

| SEK | Sweden |

| CHF | Switzerland |

| TRY | Turkey |

| GBP | United Kingdom |

Latin America (LATAM)

| Currency | Country |

|---|---|

| USD | United States |

| ARS | Argentina |

| BRL | Brazil |

| CLP | Chile |

| COP | Colombia |

| DOP | Dominican Rep. |

| USD | Ecuador |

| MXM | Mexico |

| PYG | Paraguay |

| PEN | Peru |

| UYU | Uruguay |

Pricing & Business Model

Transparent Fee Structure

- Single integration cost: Replace multiple payment provider relationships

- Real-time exchange rates: Mid-market rates aligned with top currency exchanges

- Flexible fee allocation: Absorb costs or pass fees to customers based on your model

- No hidden charges: Complete transparency with real-time cost estimates

- Optimized routing: System recommends most cost-effective channels for each transaction

Revenue Impact

- Reduced operational overhead: Single integration vs. multiple payment provider relationships

- Improved margins: Lower settlement costs and transparent pricing improve profitability

- Market expansion revenue: Access previously unreachable customer segments

- Enhanced customer lifetime value: Superior payment options increase retention

- Competitive differentiation: Offer payment methods competitors cannot match

Risk Management & Compliance

Regulatory Framework

- Global licensing: Noah maintains compliance across all supported jurisdictions

- KYC flexibility: Choose customer data sharing or utilize Noah's compliance framework

- Transaction monitoring: Automated AML and fraud detection across all channels

- Regulatory reporting: Complete audit trails for compliance requirements

- Risk assessment: Continuous monitoring across all payment methods and regions

Business Protection

- Multi-channel redundancy: Alternative payment methods ensure transaction completion

- Fraud prevention: Real-time monitoring across all supported channels

- Transaction guarantees: Clear settlement timeframes and completion assurance

- Reconciliation support: Comprehensive reporting for financial management

- Insurance coverage: Protection against operational and technical risks

Getting Started

Evaluation Process

- Business consultation: Review your global payment requirements and target markets

- Integration assessment: Evaluate technical requirements and implementation timeline

- Market prioritization: Identify highest-value regions and payment methods for initial launch

- Pilot program: Test with limited markets to validate performance and customer response

- Global deployment: Scale to full market coverage with ongoing optimization

Implementation Steps

- Choose integration approach: White-label, hosted, or dashboard-based solution

- Configure payment channels: Set up preferred methods and routing rules for each market

- Integrate API endpoint: Single integration for complete global payout capabilities

- Test across markets: Comprehensive testing with various payment methods and currencies

- Launch and scale: Begin processing with full global coverage and monitoring

Next Steps

- Schedule a demo: See the solution in action with your specific global markets

- Review market coverage: Assess which regions and payment methods best serve your customers

- Plan integration: Develop implementation timeline and market rollout strategy

- Pilot launch: Begin processing in priority markets within 2-3 weeks

Ready to unlock global markets? Contact our business development team to schedule a consultation and see how Noah's Global Payout solution can accelerate your international expansion while simplifying operations.

_For technical integration details and API documentation, see your Global Payouts Journey.